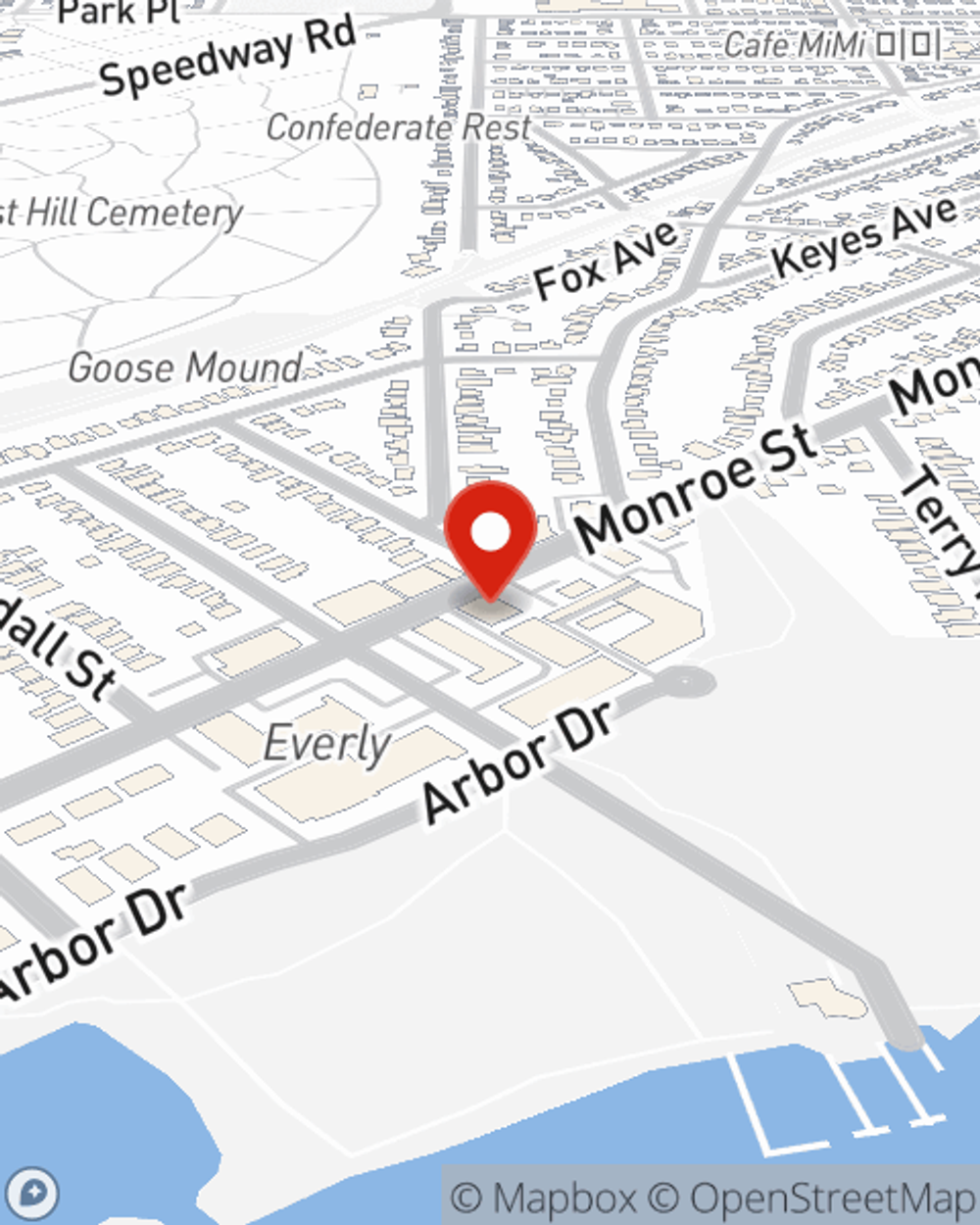

Renters Insurance in and around Madison

Your renters insurance search is over, Madison

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your TV to smartphone to bedding to pots and pans. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Madison

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Aaron Perry can help you develop a policy for when the unpredictable, like a fire or a water leak, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Madison renters, are you ready to learn how you can protect your belongings with renters insurance? Call or email State Farm Agent Aaron Perry today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Aaron at (608) 238-7107 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Aaron Perry

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.