Life Insurance in and around Madison

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Aaron Perry about life insurance. That's because once you have a family, you'll want to be ready if the worst happens.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

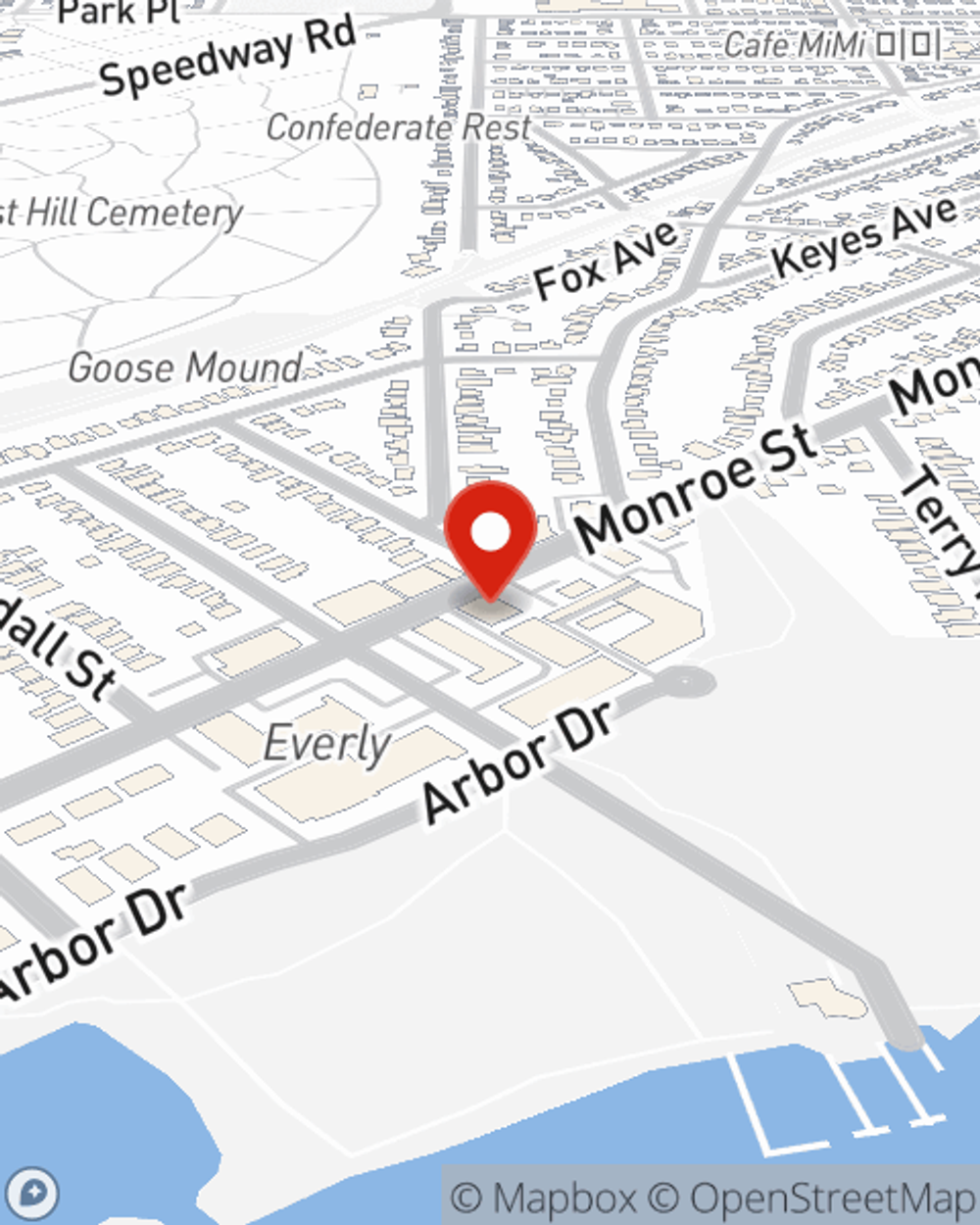

Agent Aaron Perry, At Your Service

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years coverage for a specific time frame or another coverage option, State Farm agent Aaron Perry can help you with a policy that can help cover your loved ones.

If you're a person, life insurance is for you. Agent Aaron Perry would love to help you explore the variety of coverage options that State Farm offers and help you get a policy that works for you and your loved ones. Reach out to Aaron Perry's office to get started.

Have More Questions About Life Insurance?

Call Aaron at (608) 238-7107 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Aaron Perry

State Farm® Insurance AgentSimple Insights®

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.